Senior Reporter

Senate Passes Tax Reform Bill

WASHINGTON — Congressional Republicans came closer to delivering for President Donald Trump his first major legislative achievement Dec. 2 when the Senate advanced a tax reform bill, 51 to 49, along party lines.

Proponents argued the measure would boost job creation and lead to higher wages across various sectors. Critics remain unconvinced, claiming the middle and working classes will realize very little in benefits if the bill is enacted.

Senate negotiators will now meet with their House counterparts to reconcile what could be the first major rewrite of the country’s tax code in more than three decades.

Enactment of the overhaul would enhance the link between the trucking industry and small businesses around the country, American Trucking Associations Chairman Dave Manning said during an event Republican senators hosted on Capitol Hill on Nov. 28. Businesses large and small have mostly backed the proposed overhaul.

“We’re an industry of small businesses,” said Manning, president of Tennessee-based TCW Inc. “Because of that unique position, we see every day what tax reform will do to get the economy moving ahead at full speed.”

“America’s small businesses are counting on the Senate to pass tax reform legislation,” he added, stressing that for trucking firms to grow, they need to invest in equipment and in new employees.

ATA Chairman Dave Manning joins @SBALinda @SmallBizCmte @SenateGOP this morning to call for passage of pro-growth #taxreform. pic.twitter.com/uo29fj90Kr — American Trucking (@TRUCKINGdotORG) November 28, 2017

At the same press event, Manning joined representatives from the retail sector, independent businesses and the hotel industry who called on the Senate to advance the tax bill.

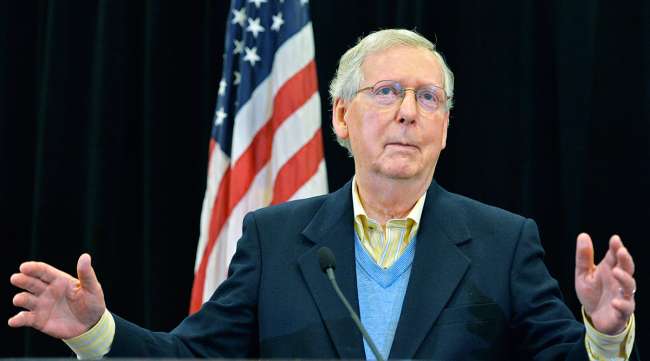

A few days later, Republicans hosted a press conference with members of the small business sector. Senate Majority Leader Mitch McConnell (R-Ky.) said his caucus was determined to advance the legislation, and proceed to reconcile differences with a House-passed version. The objective is to deliver for Trump tax legislation by year’s end. Small Business Administration chief Linda McMahon, speaking after McConnell, urged action on the bill in the Senate.

McMahon said merchants have told her, “‘Tax cuts is one of the single biggest things that you can give us to help us grow our business, and we will take that money and reinvest it in our business.’’

Moderate Republican senators who at one point were undecided supported for the bill. Maine Sen. Susan Collins (R), the chamber’s top transportation funding leader, told reporters on Nov. 30 the legislation would aim to stimulate economic growth.

“If we stimulate economic growth, then it should cause wages, which have been stagnant for the past decade, to rise,” Collins said during a briefing the Christian Science Monitor hosted in downtown Washington.

Democrats, however, rejected the tax bill. They argued the GOP measures would reward the corporate class, as well as the uber wealthy, and they continue to advocate for larger benefits for the working class.

Michigan Sen. Gary Peters (D), a senior member of the Commerce Committee, said his colleagues in the minority did not agree with the bill’s singular focus on the corporate class.

“We’re just back to trickle-down economics, which we know it’s a failure,” Peters told C-SPAN on Nov. 30.

Trump met with Republican senators Nov. 28 to champion the bill. He’s said the overhaul would deliver “big, beautiful fat tax cuts” for the middle and working class. Trump also rejects the notion billionaire families, such as his own, would benefit financially if the bill is enacted. Trump has not disclosed his tax returns, customary for presidents.

During a trip to Harrisburg, Pa. in October, Trump praised the trucking industry’s contributions to the economy, and argued tax reform would benefit freight stakeholders.

“We want lower taxes, bigger paychecks and more jobs for American truckers and for American workers,” Trump said. “Nothing gets done in America without the hardworking men and women of the trucking industry. … When your trucks are moving, America is growing. Do you agree? That is why my administration has taken historic steps to remove the barriers that have slowed you down. America first means putting American truckers first.”

The House advanced its version earlier this month. The House and Senate versions would reduce the corporate tax rate from 35% to 20%. In the House bill, that rate would take effect Dec. 31. The rate would take effect Dec. 31, 2018 in the Senate bill.

The Senate bill would keep a tax exemption for private activity bonds, which cities use to finance big-ticket infrastructure projects with private sector partners. The House bill would eliminate the exemption.

Nearly two dozen stakeholders advocating for investments in infrastructure support the private activity bonds. The American Association of State Highway and Transportation Officials and other groups wrote to House leaders in November: “The absence of [public activity bonds] could increase funding pressures across a state’s transportation plan, leading to the elimination or delay of all manner of planned projects, including those to be funded exclusively with public dollars.”