Senior Reporter

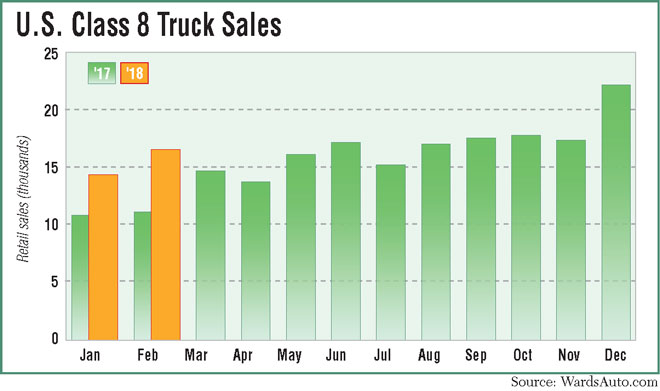

Class 8 Sales Rocket to Nearly 17,000 in February

U.S. retail sales of Class 8 trucks shot up 49% in February to nearly 17,000 units as all but one truck maker posted high double-digit gains.

Truck makers sold 16,687 units compared with 11,200 a year earlier, WardsAuto.com reported.

Year-to-date, sales climbed 40.6% to 31,145. They are forecast to surge this year compared with 2017.

“Truckers’ profits are off to the races, and when truckers make money they buy trucks,” Michael Baudendistel, a financial analyst with Stifel, Nicolaus & Co., wrote in a note to investors.

In the 2017 fourth quarter, revenue per mile (excluding fuel surcharges) for public truckload carriers rose 10% year-over-year. As a result of the new tax reform law, their net margins are expected to increase 6% to 7% compared with 4% on average, Baudendistel wrote.

“This is kind of the natural outcropping of what we have seen swelling over the last six months or so [as Class 8 orders topped 218,000],” ACT Research Vice President Steve Tam told Transport Topics.

ACT said a cycle of strong retail sales is at hand.

Its latest forecast calls for North American Class 8 sales in 2018 to increase 25% to 314,500 compared with 252,000 in 2017.

In 2019, the total is expected to stay essentially flat at 314,800, according to ACT.

“Everybody is expanding to get what [freight] they think they can get” amid vigorous freight demand, nearly full-truck utilization and high rates, said Don Ake, vice president of commercial vehicles, at research firm FTR.

“Now, in most places logistics is much harder to manage,” he said.

The demand for trucks has truck makers ratcheting up production rates, which now stretch into October at Daimler Trucks North America, the company reported.

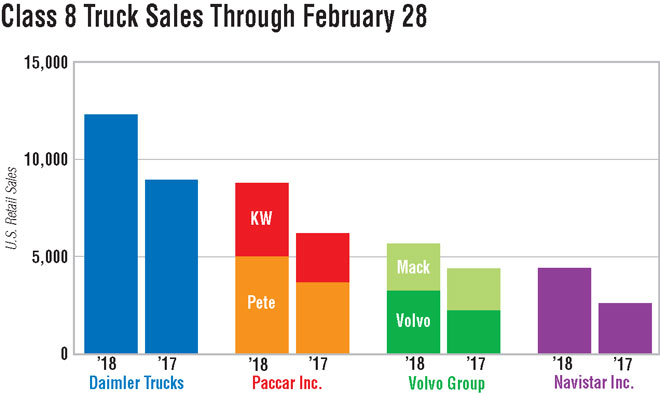

DTNA’s Freightliner brand sold a leading 6,310 heavy-duty trucks, up 46.4% from a year earlier and good for a 37.8% market share.

Western Star, DTNA’s niche brand, sold 379, up 34.9% from the 2017 period, earning it a 2.3% share.

In a survey of about 25 DTNA dealers, they reported extended lead times for Freightliner are longest for over-the-road Class 8 trucks, according to Neil Frohnapple, director of equity research at The Buckingham Research Group, who conducted the survey.

“A few dealers are concerned that customers could switch to other [truck makers] with shorter production lead times from their respective factories,” Frohnapple wrote in a note to investors.

For International Trucks, a unit of Navistar Inc., sales hit 2,244, up 71.8% from the 2017 period and good for a 13.4% share. International’s backlog also is filling out the third quarter, the company said.

“So everybody wants the best deal they can, but what they really want is the overall best value. And we’ve been very, very successful with the launch of our new products, particularly the LT [on-highway Class 8], and the A26 [12.4-liter engine] is doing extremely well also,” Michael Cancelliere, Navistar’s president of truck and parts, said March 8 during a fiscal-year first-quarter earnings call with analysts.

At Peterbilt Motors Co., sales were 2,487, up 36.9% from a year earlier and good for a 14.9% share.

Kenworth Truck Co. notched 2,100 sales, a year-over-year increase of 57.8% and good for a 12.6% share.

Peterbilt and Kenworth are units of Paccar Inc.

In February, Peterbilt introduced its Model 579 UltraLoft, an 80-inch integrated sleeper that has a 2% improvement in aerodynamics over the company’s current detachable sleeper. Production is scheduled to begin this summer.

At the same time, Paccar is not concerned with 2018 being the possible peak of the current cycle, CEO Ron Armstrong said during a recent fourth-quarter earnings call with analysts.

“We’ll flex to adjust to whatever the market demands are, and it’s a real strength of our company,” Armstrong said.

Volvo Trucks North America sold 1,973 trucks, an 88.3% gain from a year earlier, and earned an 11.8% share.

VTNA on March 14 launched its updated Class 8 VNX model designed for heavy-haul applications, which the company said made up a high-profile segment of the industry. It is available for order as a day cab, flat roof or midroof sleeper. The earlier version came on the market in 2013.

Mack Trucks sold 1,194 trucks, an 8.1% gain over the year-earlier period, for a 7.2% share.

“We expect there will be great opportunities this year,” said Jonathan Randall, senior vice president of sales and marketing for Mack Trucks North America. “We also expect some challenges along the way as we continue to keep a close eye on supply chain disruptions that can occur during a booming year.”

VTNA and Mack are units of Volvo Group.

Other truck makers did not respond to request for comment.