Senior Reporter

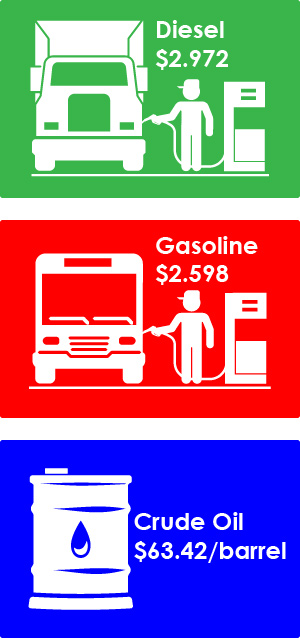

Diesel Dips 0.4¢ to $2.972; Oil Settles at $63 a Barrel

The U.S. average retail price of diesel fell 0.4 cent to $2.972 as energy production in the United States remained strong and the price of crude stalled before climbing past $63.

It marked the sixth consecutive drop in the average price of diesel, and prices have fallen 11.4 cents a gallon since Feb. 5, according to the Department of Energy.

Trucking’s main fuel costs 43.3 cents a gallon higher than it was a year ago, when the price was $2.539.

RELATED: Vehicle-miles-traveled fee ‘seems to capture all users,’ Rep. Graves says

RELATED: Alternative fuels will grow, but diesel remains go-to, Daimler exec says

The average price of diesel rose in the Gulf Coast, Rocky Mountain region and West Coast less California — and fell in all other areas according to DOE’s Energy Information Administration.

The national average price for regular gasoline rose 3.9 cents to $2.598 a gallon, EIA said. The average is 27.7 cents higher than it was a year ago.

Gas prices rose in all regions except the Central Atlantic, where they fell 0.2 cent a gallon to $2.628.

Meanwhile, National Biodiesel Day was March 18, the birthday of Rudolph Diesel, inventor of the diesel engine (which originally was designed to run on peanut oil). Biodiesel blends agricultural oils such as soybean oil, as well as recycled cooking oil and animal fats, to increase lubricity and cetane of diesel fuel. Cetane is related to the speed of ignition.

About 3.5% of the total diesel transportation fuel market, or 60 billion gallons, is biodiesel, according to the National Biodiesel Board.

At the same time, one executive at an alternative fuel company said use of Class 8 trucks running on natural gas is on the rise.

Natural gas prices are expected to moderate in the coming months, based on a forecast of record natural gas production levels, EIA said.

“The realization by trucking companies that they need to do something to meet stricter emission requirements in California is beginning to settle in,” Clean Energy Fuels Corp. CEO Andrew Littlefair said during a recent fourth-quarter earnings call with financial analysts.

Clean Energy, which is based in Newport, Beach, Calif., provides natural gas fuel and renewable natural gas fuel for transportation in North America. It supplied 351.4 million gasoline gallon equivalents of natural gas in 2017, up from 329 million GGE a year earlier, according to the company.

The Clean Air Action Plan that the Southern California ports of Long Beach and Los Angeles recently adopted calls for the introduction of near-zero engines in 2020 It also will place a fee on diesel that year, Littlefair said.

“This should dramatically change the makeup of the 16,000 heavy-duty trucks that move in and out of the ports every day,” he said.

At the same time, commercial production of the new Cummins Westport heavy-duty near-zero 12-liter natural gas engine began in February. Kenworth Truck Co. and Peterbilt Motors Co. expect to begin shipments of trucks with that engine in second quarter and Freightliner in the third quarter, Littlefair said. Also, PAC9 Transportation, which offers drayage and truckload services, recently purchased 24 natural gas trucks for its port operation in Southern California.

Kenworth and Peterbilt are Paccar Inc. brands

Freightliner is a Daimler Trucks North America brand.

The three brands together accounted for 65.3% of U.S. Class 8 retail sales in February.

Plus, the U.S. Postal Service “continues to implement aggressive mandatory carbon reduction programs with a dozens of its contract haulers,” Littlefair said. The number of heavy-duty compressed natural gas trucks operating on behalf of the Postal Service exceeds 300.

The price of crude on the New York Mercantile Exchange had stalled this month after registering its worst February drop in half a decade. The uplift in U.S. crude production has tempered the Organization of Petroleum Exporting Countries’ efforts to shrink a global glut. However, oil prices climbed past $63 a barrel March 20 when OPEC indicated supplies will come into balance with demand by the end of September, sooner than previous forecasts, according to Bloomberg News.

West Texas Intermediate crude futures on Nymex closed at $63.42 per barrel March 20 compared with $61.36 on March 12.

The weekly U.S. oil rig count was 800 during the week of March 16, four rigs more than the week before and 169 more than a year earlier, oil field services company Baker Hughes Inc. reported.

Houston-based Baker Hughes ranks No. 15 on the Transport Topics Top 100 list of the largest private carriers in North America.