US Seeks NAFTA Changes

This story appears in the June 19 print edition of Transport Topics.

The Trump administration is moving to renegotiate terms of the North American Free Trade Agreement with Canada and Mexico, and a request from the Office of the U.S. Trade Representative for comments on how to proceed has drawn a plea from the trucking industry to reshape, but not scuttle the landmark trade deal.

“NAFTA trade has become an important source of business for the U.S. trucking industry, directly supporting tens of thousands of jobs and generating billions of dollars in revenue annually,” Bob Costello, chief economist for American Trucking Associations, said in comments filed June 12. “As a result, we strongly support a do-no-harm update and modernization of NAFTA to further support the North American supply chain.”

More than 12,000 responses were filed to the agency.

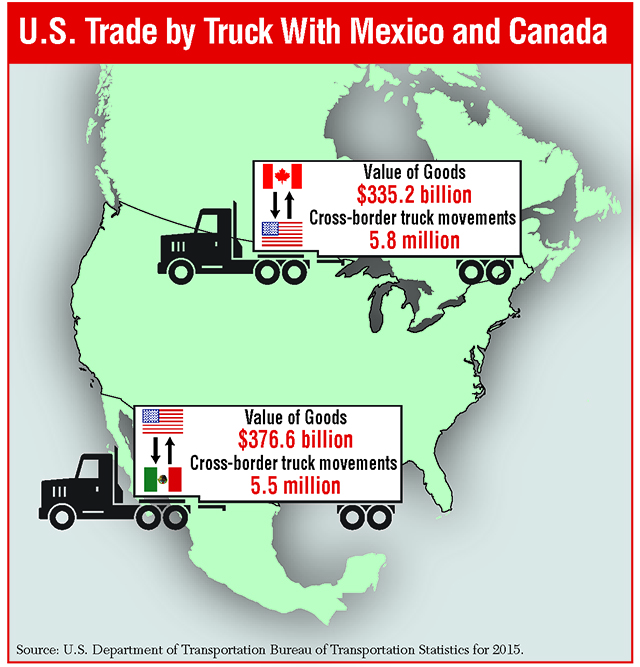

Since 1995, the value of goods hauled by truck across the U.S. northern and southern borders has more than doubled and totaled nearly $712 billion in 2015, generating a combined 11.2 million truck crossings, according to data from the U.S. Department of Transportation’s Bureau of Transportation Statistics.

Other commenters urged the Trump administration to make changes in NAFTA that improve the flow of goods across the border and promote the region as a whole.

Opportunities to enhance trade include making improvements to infrastructure, automating transactions at border crossings and expanding job training and workforce development in the region, said Tiffany Melvin, president of the North American Strategy for Competitiveness in Dallas, an advocacy group representing economic development organizations, schools and private firms in all three countries.

Trade with Mexico alone supports 26,000 direct jobs in the U.S. trucking industry and generates $3.7 billion in annual revenue for U.S. trucking companies, Costello said, adding that trade with Canada likely would be similar in magnitude.

He said transportation across the U.S.-Mexico border could be handled more efficiently by permitting commingling of cargo.

“Presently, motor carriers sending cargo into or out of Mexico may not commingle freight that is processed by different brokers in a single trailer,” Costello noted. Changing this provision would reduce congestion by reducing the number of trailers needed to move goods across the border and speeding up inspections by customs authorities.

Congestion on U.S. highways added more than $63.4 billion in operational costs to the trucking industry in 2015, according to the American Transportation Research Institute.

Two representatives of FedEx Express, senior counsel David Short and Ralph Carter, managing director for legal, trade and international affairs, offered their defense of NAFTA, saying the trade pact has brought growth to its business and created new business opportunities for FedEx customers.

“One of the most important and often underappreciated benefits of NAFTA is its role in creating an integrated North American production platform that makes the U.S. economy and U.S. products more globally competitive,” Short and Carter wrote in a letter to the trade representative’s office.

“If a goal of the negotiations is to create greater balance in trade flows among the NAFTA partners, this should be done through measures that promote U.S. exports rather than by measures to restrict imports from Canada and Mexico,” the two men said.

Nevertheless, the trade pact signed 23 years ago can and should be updated to reflect changes in the way business is conducted, the FedEx officials said.

“American companies lead the world in e-commerce infrastructure, including e-commerce platforms, e-retailing, electronic payments, telecoms, software, logistics and search engines,” Short and Carter said. “However, the huge potential of e-commerce in North America for U.S. exporters has yet to be fully realized because of the complexity, cost and unpredictability of moving low-value, individual shipments across Mexican and Canadian borders.”

Canada and Mexico assess duties and taxes on goods ordered online once the value of an order exceeds a minimum level. In Canada, the threshold is $15 and in Mexico it is $50, which are among the lowest in the world and compare with a statutory “de minimis” level of $800 in the United States.

“These protectionist policies are designed to insulate traditional brick-and-mortar retailers from the competition U.S. e-tailers are prepared to offer,” the FedEx officials said. “The NAFTA review provides a prime opportunity to rectify this barrier to U.S. exporters.”

Also, Melvin urged the Trump administration to “eliminate all current and future considerations for any sort of border tax between Canada, the United States and Mexico.”

A 20% tariff on Mexican imports would add $15 billion to the cost of parts for manufacturers of cars and trucks in the United States and potentially eliminate between 25,000 and 50,000 jobs, according to comments filed by the Motor & Equipment Manufacturers Association.

Michael Mullen, executive director of Express Association of America, said he would like to see changes in regulations that prevent foreign-owned less-than-truckload and package delivery firms from operating trucks in Mexico.