Staff Reporter

Diesel Price Climbs 9.3¢ to $4.633

[Stay on top of transportation news: Get TTNews in your inbox.]

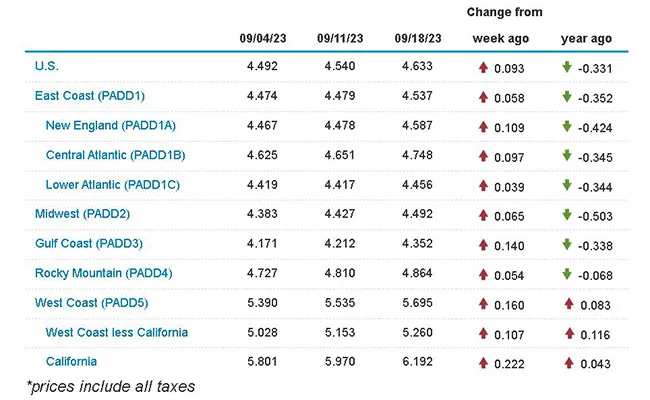

The national average diesel price continued its steady ascent, rising 9.3 cents week-over-week to reach $4.633 a gallon, according to Energy Information Administration data released Sept. 18.

The average on-highway price for diesel has risen 82.7 cents a gallon over the past nine weeks. The most recent price decline for trucking’s main fuel was 3.9 cents July 10.

A gallon of diesel now costs 33.1 cents less than it did at this time in 2022. In contrast, at the end of the first half of 2023, the discount to the cost of trucking’s main fuel 12 months earlier was more than $1.90.

Diesel’s average price climbed in all 10 regions in EIA’s weekly survey. The largest gain was 22.2 cents in California, pushing the state average back over $6 a gallon. The smallest increase was 3.9 cents in the Lower Atlantic.

The average price for a gallon of gasoline bumped up 5.6 cents to $3.878.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Further upside is expected for retail diesel prices, analysts say, with an on-highway national average of $4.75 a gallon likely in the short term and then $5 a gallon a possibility during the winter.

Among the supportive short-term freight market factors are harvest season in the Midwest and peak shipping season on the demand side of the equation and refinery turnarounds on the supply side; also, wholesale diesel and crude futures prices remain buoyant.

Harvest season is well underway but a couple of weeks away from its peak, GasBuddy Head of Petroleum Analysis Patrick de Haan told Transport Topics.

Shipping season’s peak typically also tends to be the last week in September. Demand for shipping is being underpinned by a more resilient U.S. economy than expected.

U.S. average on-highway #diesel fuel price on September 18, 2023 was $4.633/gallon, UP 9.3¢/gallon from 9/11/23, DOWN 33.1¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZFztg pic.twitter.com/MASUv3KcFE — EIA (@EIAgov) September 19, 2023

The Organization for Economic Cooperation and Development said Sept. 19 it expected 2.2% U.S. GDP growth in 2023, compared with a forecast of 1.6% GDP growth in a June outlook. And on Sept. 15, the Federal Reserve reported that manufacturing output increased 0.1% in August after a 0.4% improvement in July.

Support on the supply side is coming from refinery turnarounds, especially on the Atlantic Coast. Irving Oil’s 320,000-barrels-per-day Saint John refinery in New Brunswick was scheduled to shut down Sept. 17 for several weeks. The facility ships much of its diesel output to New York. Also, Delta Airlines unit Monroe Energy is carrying out maintenance on the 185,000-barrels-per-day Trainer refinery near Philadelphia.

There is more maintenance on the way across the U.S., which is likely to add to the upside pressure, De Haan said.

Underlying wholesale diesel and crude prices continue to provide substantial support too, with the front-month CME ULSD futures contract reaching $3.50 per barrel Sept. 14 for the first time since January after a precipitous rise over the past two months.

Benchmark front-month WTI crude futures, meanwhile, breached $90 per barrel Sept. 18 for the first time since November 2022, largely as a result of production curtailments by Saudi Arabia and its OPEC+ allies cutting the amount of oil in circulation, especially heavier blends that produce more diesel.

“The diesel market is set to be strapped onto a roller coaster for this winter,” De Haan said. If anything goes wrong at U.S. refineries in the coming months, it may start a domino effect, he said.

U.S. average price for regular-grade #gasoline on September 18, 2023 was $3.878/gal, UP 5.6¢/gallon from 9/11/23, UP 22.4¢/gallon from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/7zq1p5nq1s — EIA (@EIAgov) September 19, 2023

Even if Saudi Arabia and its allies ramped up crude production again, the U.S. has seen a decrease in excess of 1 million barrels per day in its refining capacity in recent years, said Wood Mackenzie Principal Analyst Austin Lin. The market is very tight for all fuels as a result of the decrease in refining capacity, Lin said.

Overall, the U.S. is producing around 5 million barrels a day of diesel, about 200,000 barrels per day less than it was a year ago, Lin said. Tightness increases seasonally as refinery maintenance outages rise in the spring and fall, he said, adding that refinery output should improve in November after the maintenance outages are due to end.

However, the supply situation is not looking quite as desperate as it was 12 months ago, said De Haan, noting that storage inventories were 6% higher year-over-year through Sept. 8 at 6.5 million barrels.

Speaking at the FTR Transportation Conference 2023, Stifel Associate Vice President Bruce Chan said the increase in fuel prices is likely to see more trucking companies exit the business. Smaller carriers are especially vulnerable, said FTR Transportation Intelligence Vice President of Trucking Research Avery Vise. The first seven months of 2023 already saw the exit of 55,000 carriers, primarily small carriers, because of the weak freight environment, Vise added.

Want more news? Listen to today's daily briefing below or go here for more info: