Global Fuel Prices Are Surging With Supply Risks Ahead

[Stay on top of transportation news: Get TTNews in your inbox.]

Disruptions on the world’s major trade routes, refinery closures and resurgent demand are pushing up global fuel prices and making forecasts difficult in the run-up to a U.S. presidential election in which inflation will be a key issue.

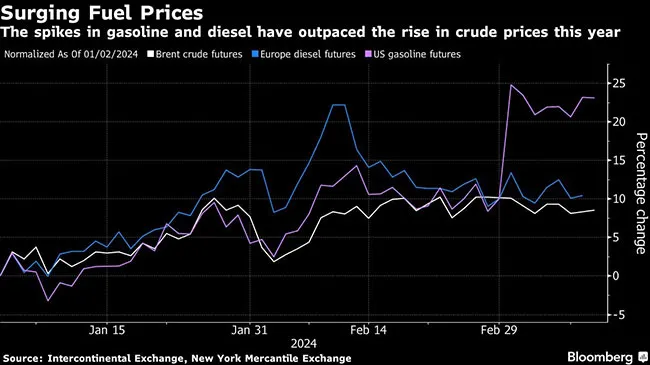

Increases in the two most consumed fuels are outpacing those for crude oil in some of the world’s most important markets. U.S. gasoline futures have jumped sharply in recent weeks — thanks, in part, to the summer specification switch — and are now up by more than a fifth so far this year, while diesel in Europe has risen 10%. Refiner profits are also above seasonal norms in many regions, a sign of tightness as the summer travel period approaches.

Interruptions to fuel production — a combination of scheduled work, unplanned outages and drone attacks on Russian facilities — have been lifting prices. They’ve come on top of higher shipping costs caused by Houthi attacks in the Red Sea and drought at the Panama Canal, as well as the supply chain disruptions spurred by Western sanctions on the Kremlin.

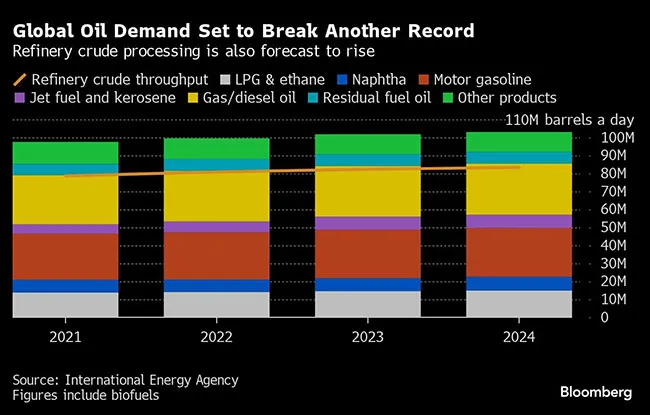

And while more than a million barrels a day of new refining capacity is set to come online this year, these projects are notoriously prone to delays. The various moving parts are making it tough to forecast how much fuel will be available in a year in which global oil demand is set to break another record, and voters in the world’s largest economy will head to the polls.

There’s a risk that premium gasoline prices could reach a multiyear high this year, said Mukesh Sahdev, head of oil trading and downstream research at Rystad Energy AS.

“There’s not a lot President [Joe] Biden can do in time for the election, if this happens,” he said. “Strategic petroleum reserves are low, and there are few levers for the U.S. government to pull to lower gasoline prices.”

RELATED: Diesel Price Dips 1.8¢ in Third Straight Decline

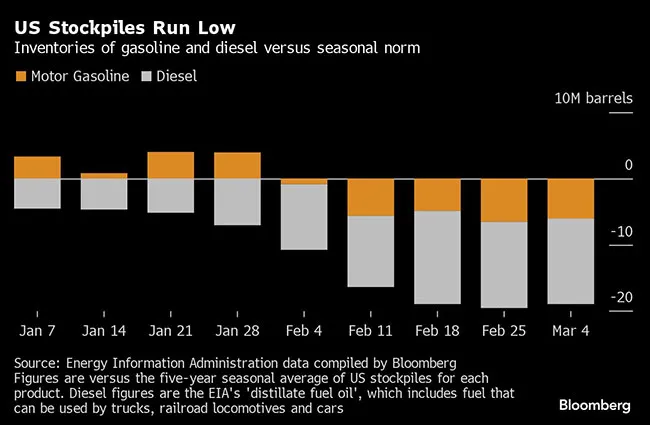

The average gasoline price at the pump in the U.S. is now 60% higher than at the start of November 2020 — a potentially significant factor for American voters when comparing how well-off they feel now versus when Biden was first elected. And while pump prices are rising relatively slowly for this time of year, U.S. fuel stockpiles well below seasonal norms will keep refining margins elevated, according to the Energy Information Administration.

As a result, the agency on March 12 raised its second-quarter retail gasoline price forecast by 20 cents a gallon.

Distillate cracks — the cost of diesel and jet fuel over crude prices — will benefit from very lean inventories and lower production in the short term, as refiners prioritize gasoline output, Goldman Sachs Group said in a note.

One of the biggest U.S. refiners, Valero Energy Corp., said earlier this year that it expects a lengthy startup period for new global capacity coming on stream, which will mean the supply-demand balance remains relatively tight for the near future.

Nigeria’s massive Dangote refinery has, after years of delays, finally started to export fuel. But questions remain over when it will reach full capacity and the timeline for specific units — which impact the type of petroleum products it makes — coming online. It’s a similar story for Petroleos Mexicanos’ Dos Bocas plant in Mexico.

“We expect refined product margins to remain elevated and volatile relative to history,” said Daan Struyven, head of oil research at Goldman Sachs. Strong demand growth for refined products will be roughly in line with net gains in refining capacity, this year and next, he said.

RELATED: Will There Be a Diesel Shortage in 2024?

Then there’s the question of what disruptions to the supply of crude and feedstocks mean for fuel output. Sanctions on Russian oil, rising U.S. shale production, OPEC+ cuts and changes to global trade flows caused by vessels avoiding the Suez Canal route because of Houthi attacks all feed into fuel production.

For the global gasoline market, one of the biggest question marks is over the availability of octane-enhancing blending components used to make the fuel, particularly with the U.S. summer driving season approaching.

Sanctions placed on Russia following its invasion of Ukraine have helped lighten the crude slates in Europe and the U.S., pressuring output of components like alkylate and reformate, said Jorge Molinero, an analyst at Sparta Commodities. The problem isn’t expected to go away this year, he said.

Overall, global crude refining capacity is forecast to rise by more than 1.5 million barrels a day this year, slightly outpacing demand growth of 1.4 million — although the outlook differs depending on the fuel, said George Dix, a refining analyst at consultancy Energy Aspects Ltd.

Oil product margins are expected to be lower than in 2023 but above historical levels, he said. That’s because of new plants taking time to come online and inefficiencies in refining created by Russian crude and petroleum product rerouting, he added.

Written by Jack Wittels, Elizabeth Low and Josyana Joshua

Want more news? Listen to today's daily briefing below or go here for more info: