Retail Sales Soared a Record 17.7% in May, Double Forecast

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

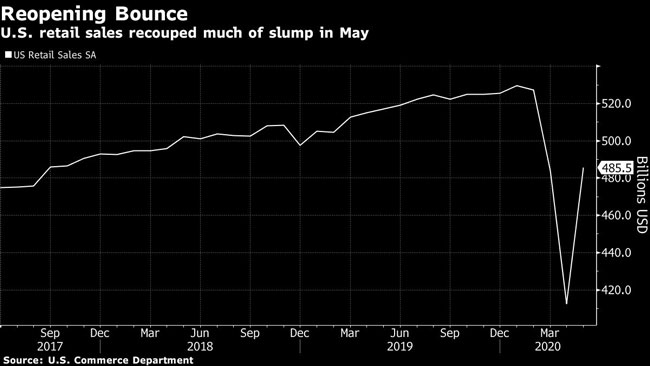

U.S. retail sales jumped in May by the most on record and double forecasts, regaining more ground than expected after unprecedented drops the prior two months as states allowed more merchants to reopen.

Sales soared 17.7% from the prior month, the most in data going back to 1992, following a revised 14.7% slump in April, according to Commerce Department data issued June 16. The median forecast in a Bloomberg survey of economists called for an 8.4% gain in May.

U.S. stocks surged at the open and 10-year Treasury yields were higher after the report.

All categories increased in May, including a 44.1% surge in sales of motor vehicles and a 29.1% jump in restaurant receipts. Together, those categories accounted for more than half the overall gain in sales. Even with the improvement, the value of all retail sales remained 6.1% below last year’s level.

“As states began to reopen their economies, households reopened their wallets,”said Andrew Grantham, economist at CIBC. “However, this is probably the easier part of the recovery in consumer spending, with pent-up demand as consumers sat at home supported by stimulus checks many households received in April. While those factors could support another strong gain in sales in June, thereafter the recovery will get slower and more uneven.”

A separate report June 16 showed industrial production rose in May by less than estimated, indicating a more gradual recovery for manufacturing.

The retail figures suggest that the economy is rebounding faster than anticipated after entering in February what’s likely to be the steepest downturn since the Great Depression. After months of being stuck at home, Americans began to travel and shop as states relaxed lockdowns on businesses. An uptick in the labor market in May and income support for those who lost their jobs during the pandemic helped underpin spending.

President Donald Trump touted the strong numbers in a tweet.

Wow! May retail sales show biggest one-month increase of ALL TIME, up 17.7%. Far bigger than projected. Looks like a BIG DAY FOR THE STOCK MARKET, AND JOBS! — Donald J. Trump (@realDonaldTrump) June 16, 2020

Among other categories, sales at clothing stories nearly tripled in May from a month earlier, while purchases at building materials outlets climbed 10.9% and nonstore sales, which consist mainly of Internet purchases, rose another 9%.

The increase in auto sales is consistent with separate data from Wards Automotive Group earlier this month that showed a 42% advance from the prior month to the highest level since February.

The so-called “control group” subset of sales, which excludes food services, car dealers, building-materials stores and gasoline stations, increased 11% from the prior month. In more normal times, the measure is viewed as a better gauge of underlying consumer demand, though that’s less the case now.

The figures corroborate other data showing the economy is stabilizing. Figures from the Federal Reserve Bank of New York on June 15 showed a gauge of manufacturing in the state rose more than forecast in June. A measure of consumer sentiment also jumped in early June by the most in four years on improvement in the labor market.

Still, risks remain as the number of COVID-19 cases is rising in some states that have recently reopened, including populous Texas and Florida, which announced record new cases June 14.

The Census Bureau said that data quality was broadly unaffected by COVID-19. The agency continued to use the same standard weighting and estimation methods, they did not change their data collection methods and the reliability “has not changed substantially.” The margin of error was slightly higher in April in May, it said.

The Census Bureau changed its seasonal adjustment procedure since March, to ensure the data “fully include any immediate effects” that aren’t regular seasonal factors such as holidays.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More