Staff Reporter

Several States Alter Fuel Tax Structures

[Stay on top of transportation news: Get TTNews in your inbox.]

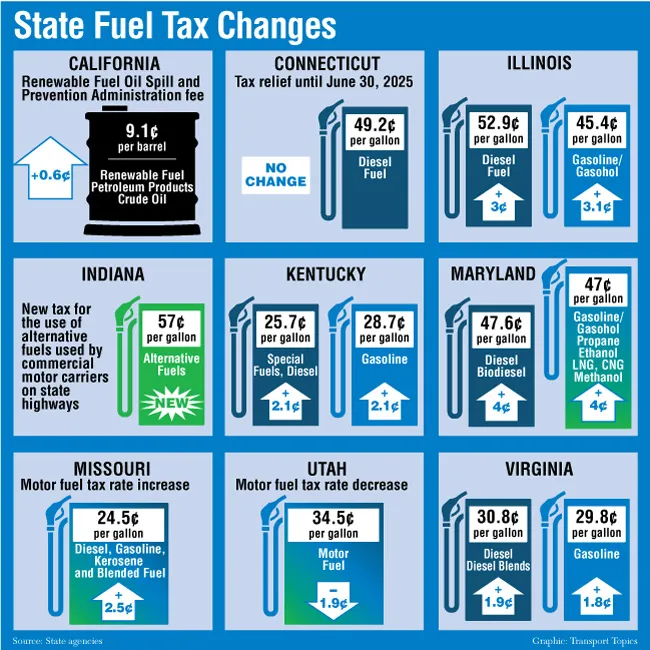

Higher gasoline and diesel taxes hit the pumps in several states starting July 1, while new laws also took effect to raise revenue from the sale of alternative fuels.

On July 1, California’s Department of Tax and Fee Administration adjusted its Oil Spill and Prevention Administration fee to 9.1 cents per barrel of renewable fuel, petroleum products and crude oil from 8.5 cents. In January 2022, the fee program, which provides money to protect wildlife affected by oil spills, was expanded to include all renewable fuels.

“Marine terminal operators, refinery operators, renewable fuel receiving facility operators and renewable fuel production facility operators are responsible for collecting the OSPA fee from the owner,” a special notice stated.

Due to the passage and enactment of House Bill 1050, Indiana has begun to tax the use of alternative fuels used by commercial motor carriers conducting their operations on state highways. As of July 1, the state began levying a 57 cents-per-gallon tax for alternative fuels, such as hydrogen “or any other fuel used to propel a motor vehicle on a highway that is not subject to certain taxes.”

Lawmakers expanded the definition of alternative fuels for motor carrier fuel tax to accommodate growing and future use of lower-emission vehicles. Also in Indiana as of July 1, the tax on gas nudged up 1 cent to 34 cents per gallon.

Noem

Starting July 1, South Dakota broadened its list of taxable fuels to include biodiesel/biodiesel blends, liquid natural gas, liquid petroleum gas and compressed natural gas to be added to the International Fuel Tax Association (IFTA) agreement for tax collections. This development is due to Senate Bill 71, which was passed in the 2023 state Legislature and signed into law by Gov. Kristi Noem in February.

As of July 25, the only new alternative motor fuel type listed under the third-quarter 2023 IFTA tax rates for South Dakota was biodiesel, which is taxed at 28 cents per gallon, the same rate as diesel. The new law allows additional motor fuels to have an excise tax imposed in South Dakota when used in an engine fuel supply tank for qualified motor vehicles involved in interstate commerce. The bill set the fuel excise tax rates per gallon for special fuel and biodiesel/biodiesel blends at 28 cents, CNG at 10 cents, LNG at 14 cents and liquid petroleum gas 20 cents.

Meanwhile, prices for diesel and gas rose in other states.

Illinois: Per-gallon taxes on motor fuel climbed July 1 through June 30, 2024, for diesel to 52.9 cents per gallon (3 cents higher) and to 45.4 cents (3.1 cents more) for gasoline/gasohol.

How effective have third-party services proved to be for fleets? Let's find out with Michael Precia of Fleetworthy Solutions and Dan Rutherford with Summit Virtual CFO by Anders. Tune in above or by going to RoadSigns.ttnews.com.

Kentucky: The Department of Revenue bumped up motor fuel taxes per gallon on gasoline (26.6 cents to 28.7 cents) and on special fuels including diesel (23.6 cents to 25.7 cents) as of July 1.

Maryland: New tax rates were ushered in on several types of fuel in July, raising prices by 4 cents. Diesel and biodiesel are now at 47.6 cents per gallon. Gasoline/gasohol, propane, ethanol, LNG, CNG and methanol are 47 cents.

Missouri: From July 1 through June 20, 2024, the state increased its motor fuel tax rate 2.5 cents to 24.5 cents per gallon. Motor fuel is defined to consist of diesel, gasoline, kerosene and blended fuel.

Virginia: The Department of Motor Vehicles, designated as the state agency responsible for levying motor fuel excise taxes, raised rates on diesel and diesel blends (now 30.8 cents per gallon from 28.9 cents) and gasoline (to 29.8 cents from 28 cents a gallon).

In related developments, Utah lawmakers this year decided to lower motor fuel rates starting July 1 to 34.5 cents per gallon from 36.4 cents. House Bill 301 on transportation tax amendments was enacted March 22 by Gov. Spencer Cox.

Similarly, Connecticut state legislators tucked a tax relief measure into House Bill 6941 for the state budget for the biennium ending June 30, 2025, setting the diesel fuel tax rate at 49.2 cents per gallon for fiscal years 2023 and 2024. The tax freeze avoided a July 1 increase of 12 cents per gallon. The bill was signed by Gov. Ned Lamont on June 12.

Want more news? Listen to today's daily briefing below or go here for more info: