Bloomberg News

A Weakening Diesel Market Is Becoming a Problem for Oil

[Stay on top of transportation news: Get TTNews in your inbox.]

The global diesel market is deteriorating, a concerning economic signal and food for thought for bullish oil traders.

In Europe, the U.S. and Asia, futures markets have slumped into what’s known as contango, whereby more immediate prices don’t command premiums. It’s generally viewed as a sign of weakness.

“There is a genuine weakness in the physical market, as reflected in growing contango in diesel futures contracts,” said Tamas Varga, an analyst at brokerage PVM. “There’s a general feeling of souring of sentiment.”

Diesel is an important component of oil demand. The fuel is used to power trucks and cars, as well as heavy industry such as agriculture and mining.

Alongside gasoil, which is a similar product but higher in sulfur, about 28.2 million barrels were consumed in 2022, according to the Energy Institute Review of World Energy. Overall oil demand that year was about 97.3 million barrels a day, its figures show.

But signs of anemic consumption of the fuel are popping up, even if this can be a period of weakness anyway.

A measure of U.S. demand — the amount of distillate fuel supplied — has averaged 3.66 million barrels a day so far in 2024, the worst start to a year since 2016 and well below 2020 levels when COVID was affecting consumption, Energy Information Administration data shows.

In Europe, where drivers have been moving away from the fuel, sales have been on a downward spiral. French sales of both non-road and road diesel slumped by 12% year-on-year in March. The most recent data from Germany, Italy and the U.K. also pointed to annual declines.

Even in China, the engine of demand growth for oil, weak local consumption is causing exports to surge. Diesel sentiment across Shandong — where so-called teapot refineries are geared to making the fuel — is soft.

The market’s main bearish fundamentals include sluggish economic recoveries in major regions, and a significant increase in diesel-making capacity in Africa, the Middle East and Mexico, according to James Noel-Beswick, an analyst at Sparta Commodities.

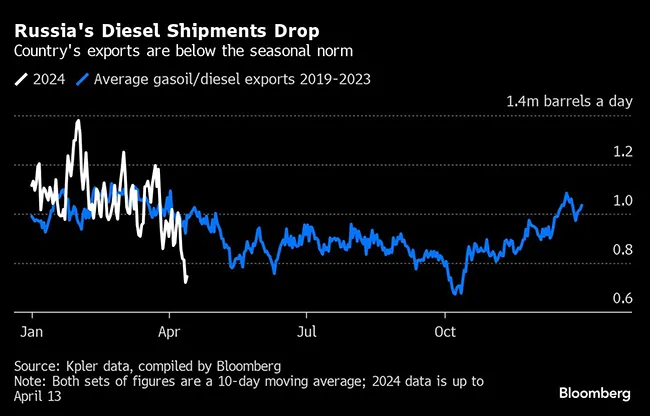

An indicator of how weak the market has become is how easily it has coped with a slump in supply from Russia, where Ukrainian drone strikes have disrupted the nation’s oil refineries.

Data from analytics firm Kpler show that Russian shipments averaged 740,000 barrels a day in the 10 days through April 13. That’s down by about 25% compared with the average at this time of year between 2019 and 2023.

Want more news? Listen to today's daily briefing below or go here for more info: