Staff Reporter

Diesel Price Remains Unchanged at $4.109

[Stay on top of transportation news: Get TTNews in your inbox.]

The national average price for a gallon of diesel fuel remained unchanged at $4.109 last week, the first time there was no fluctuation since last summer, according to Energy Information Administration data for the week of Feb. 19.

The last time the national average diesel price remained unchanged in consecutive weeks was July 10 and July 17, when it cost $3.806 a gallon.

Diesel’s price had climbed in four of the prior five weeks, including a 21-cent jolt Feb. 12.

A gallon of diesel costs 26.7 cents less on average than at this time in 2023.

U.S. average on-highway #diesel fuel price on February 19, 2024 was $4.109/gallon, no change from 2/12/24, DOWN 26.7¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZFztg pic.twitter.com/jUJPcyWJpk — EIA (@EIAgov) February 21, 2024

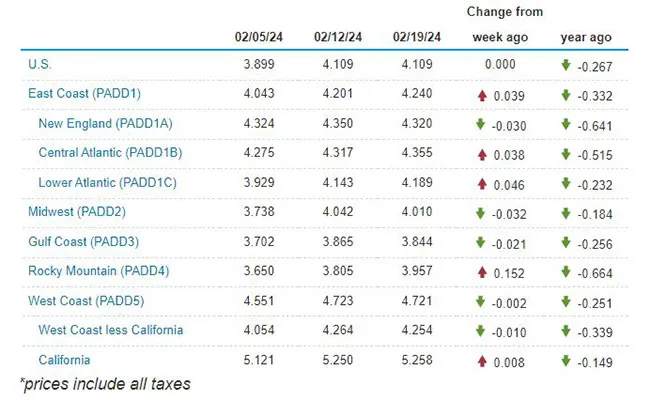

Average diesel prices went up in five of the 10 regions in EIA’s weekly survey and down in five. The greatest increase was 15.2 cents a gallon in the Rocky Mountain area; the steepest decrease was 3.2 cents in the Midwest.

Meanwhile, the average price for a gallon of gasoline climbed 7.7 cents to $3.269, marking a 13.3-cent increase in the past two weeks. Despite the gain, a gallon of gas still costs 11 cents less than it did a year ago.

Diesel prices steadied after jumping a week earlier in the wake of refinery issues, particularly an unplanned outage at BP’s Whiting plant in Indiana, the largest refinery in the Midwest. The refinery shut Feb. 1. Front-month benchmark diesel futures prices pushed toward $3 per gallon as Valentine’s Day approached on the back of the Whiting outage and crude strength.

In the ensuing week, front-month diesel futures declined as much as 10% and benchmark crude futures held relatively steady, failing to breach the psychologically important $80-per-barrel mark despite ongoing geopolitical tensions. Part of that is because demand from the freight sector continues to wallow, according to the latest data.

Truck tonnage declined on both an annual and sequential basis in January, icing any hopes that a new year would bring the start of a turnaround for the freight sector after a rough 2023, American Trucking Associations data shows.

U.S. average price for regular-grade #gasoline on February 19, 2024 was $3.269/gal, UP 7.7¢/gallon from 2/12/24, DOWN 11.0¢/gallon from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/qA4vpep6K3 — EIA (@EIAgov) February 21, 2024

ATA’s For-Hire Truck Tonnage Index fell 4.7% to 111.0 from 117.1 a year earlier, the trade association said Feb. 20. The index declined 3.5% on a month-to-month basis from December’s 115.0 mark.

Costello

“January’s data was a snap back to reality for anyone thinking the freight market was about to turn the corner,” Bob Costello, ATA chief economist, said in a statement. “Bad winter weather in January likely hurt volumes, not to mention sharp drops in a number of drivers of tonnage including retail sales, housing starts and manufacturing output.”

February has been little different, according to EIA data issued Feb. 22. Distillate fuel product supplied — a proxy for diesel demand — averaged 3.8 million barrels a day over the past four weeks, down by 0.6% from the same period last year, EIA said.

However, other macro-economic data is more favorable. The Logistics Managers’ Index for January was 55.6 compared with 54.7 in the year-ago month.

The LMI is issued by five colleges and the Council of Supply Chain Management Professionals. An LMI reading above 50 indicates the sector is expanding; a reading under 50 signifies a contraction.

That said, optimism is widespread that the freight market has reached its nadir.

Koeck

Volvo Trucks North America Vice President of Strategy, Marketing and Brand Management Magnus Koeck told reporters recently the company was optimistic the freight market had reached its bottom.

Fuel prices were one of the bright spots for carriers in 2023 during the freight recession and optimism remains in place that the upside on prices is limited, even with geopolitical tensions on the up. Spare crude production and refining capacity are expected to keep a cap on prices down the road, according to analysts.

“Output cuts have translated into an increase in spare production capacity. With this backdrop, long dated oil remains anchored at $70 per barrel, resulting in relatively backwardated global crude oil curves,” Bank of America Commodity and Derivative Strategist Francisco Blanch said Feb. 21 in a research note. Backwardation is where the current price of an asset is higher than the forward market.

“Key policy measures by the Biden administration on Russia, Iran and Venezuela, a surge in U.S. shale output, coupled with warm weather and more renewables, as well as steep interest rate hikes by the Fed and ECB, have forced OPEC+ to cut oil production repeatedly to firm up markets,” Blanch said.

U.S. refineries ran at 80.6% of their operating capacity in the week that ended Feb. 16, compared with 92.6% in the week that ended Jan. 12 and a capacity utilization of 85.6% in February 2023.

Distillate fuel production averaged 4.2 million barrels per day on a rolling four-week basis, compared with 4.6 million barrels in the same period a year earlier, the data shows.

Meanwhile, distillate fuel inventories decreased by 4 million barrels in the week that ended Feb. 16 to 121.7 million barrels and are about 10% below the five-year average for this time of year. A year earlier, stocks totaled 121.9 million barrels.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: